Stocks

Futures

Forex

Indexes

& more

Automated Bot Trading

Learn automated bot trading within our software in a "small study group" of up to 15 students.

Learn everything you need to setup, backtest, deploy, optimize, review and build a run sheet.

Go from a total newbie to an bot "ninja" and run multiple bots and strategies on your desktop or in the cloud. Everything

you need to learn, test and launch your own trading bots. During the 8-session class, Matt shares his favorite bots with you.

NOTE: You do NOT need to know how to write code, Matt provides his favorite bots in class.

May 2024 Schedule

May 7 - 30

Tuesdays and Thursdays

8:30am EST

BOT Trading

with Matt DeLong

15 students MAX

May 7 - 30

Tuesdays and Thursdays

8:00pm EST

BOT Trading

with Matt DeLong

15 students MAX

$1,799 includes the following

Includes link for download of software automation platform

Include a backtesting tool to assess numerous variations of pre-built bots automatically.

2 pre-built bots and videos explain their strategies.

Includes 8 LIVE classes (2x a week), each class ~ 1 hour

Includes online video resources and community

Includes 60-days of PREMIUM community (30-days after completion)

Certificate of completion

Top Questions

#1 Can I use bots to help get a funded account unlocked?

Yes, that is one of the top reasons traders use the bots, in addition to the time freedom.

#2 If bots make the trades for me, why do I need a class?

Bots are sophisticated technology, you need to understand how to test & operate them.

#3 Once class ends, will the bots still be available to use?

Yes, you can use the bots as long as you like. At the end of class, you're also offered a 30-day free trial of the premium community, but the bots function independently, regardless of whether you join the optional / premium community.

#4 Once class ends, how much support is there for questions, troubleshooting, etc?

You will get 30-day of the $150/month (optional) premium community, plus access to bot specific community resources, updates, and a weekly 30-minute live Q&A video for questions, which provides ongoing bot trading support.

Class is for traders who

Struggle with trading

Emotions, decision making all over the place

Freeze, don’t know what to do

Can’t seem to figure it out

Think you don’t have what it takes

Struggle with consistency

What you will learn

Everything you need to know to launch trading bots inside our software.

How to download and install Matt's trading bots.

How to review, optimize and monitor live bots.

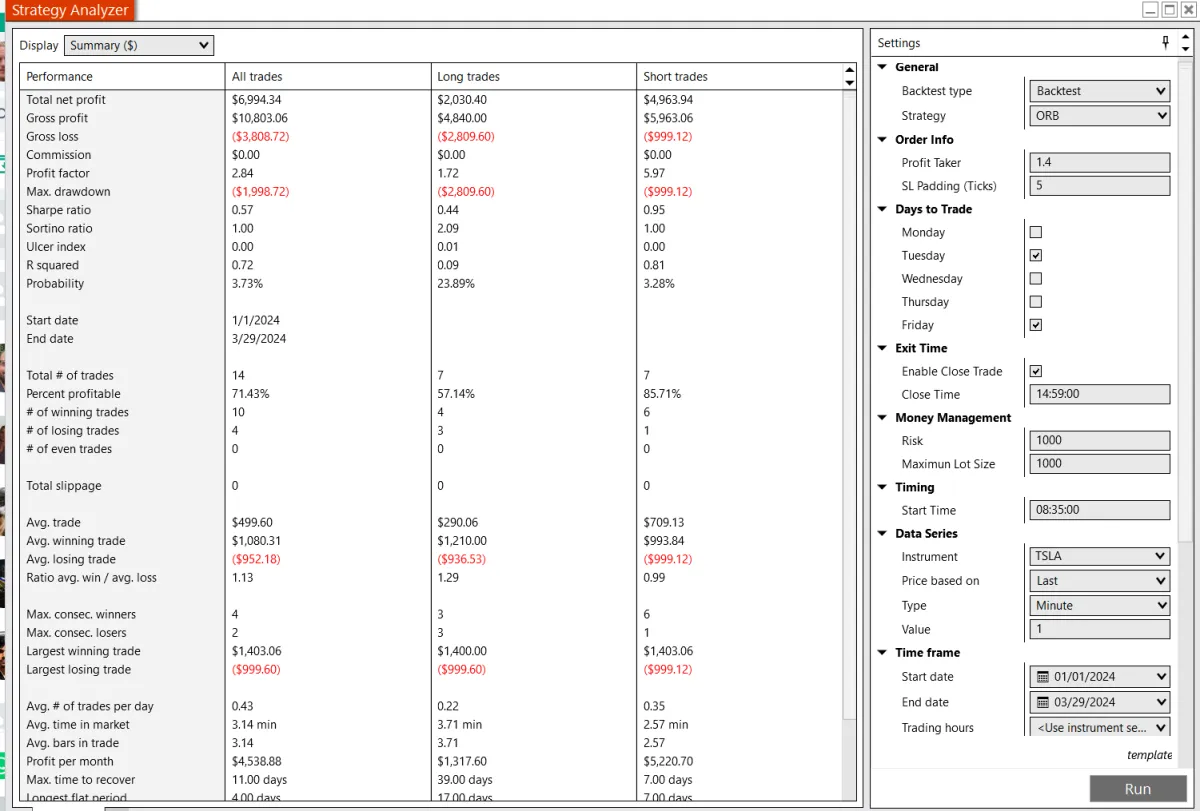

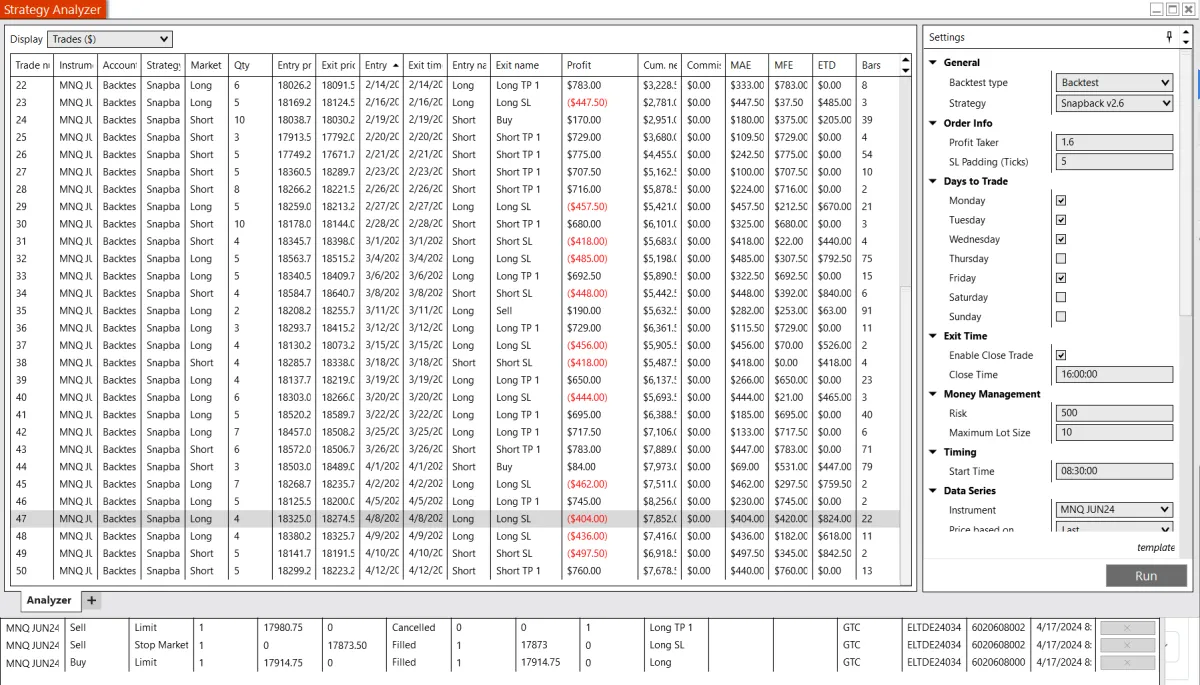

How to backtest, review and do a deep dive on backtest reports.

How to setup and deploy bots both on your desktop and in the cloud (VPS).

Data Driven Decision Making

Bot trading uses advanced technology to automatically execute trades according to preset rules, offering numerous benefits, including "data driven decision making", which means using data and statistics to help make choices and trading decision. Instead of just guessing or going with your gut feeling, facts, analytics, and numbers are used to figure out the best trades to take. It's like using evidence to make smarter trading decisions.

Emotion-Free Trading

Automated bot trading are not subject to human emotions and feelings, which often cloud judgment and lead to poor trade decisions.

Extremely Fast Trading

Automated bot trading can make trades much faster than a human can and can execute those orders before you can blink.

Automated Backtesting

Automated bot trading can back test strategies using historical data to see how they would have performed under different market conditions.

Class Outline

Class 1 - Intro to Bot Trading Software

Intro to the Ninja Trader 8 bot trading software platform, how to connect accounts, launch charts, add indicators and more. Review of bot 1 (day trading bot), download and import bot, and review back tests on select assets, and basic settings required to run a full back test inside the strategy analyzer.

Class 2 - Bucket Testing Multiple Assets

Review and troubleshooting backtest results, export trade results, bucket testing multiple tickers in asset classes, discussion of start time and close time settings, isolating winning results using the "profit factor", and practice bucket testing.

Class 3 - Single Day Optimizations

How to identify backtest anomalies, day of the week testing for single day optimization, data series timeframe testing, optimization testing of other settings, how to save settings templates & reload settings templates.

Class 4 - Review of Backtests

Review student backtests and intro to bot 2 (day trading bot) as well as review of optimization testing as well as using templates and the process of placing a bot with newer versions.

Class 5 - GO LIVE with bots on your Desktop Computer

How to attach a bot to LIVE charts, configuring GO LIVE, adjusting settings, checklist for going LIVE, configuring LIVE accounts, using templates, and more. The BOT technology works with traditional brokers like TD Ameritrade, Interactive Brokers and dozens of funded account programs.

Class 6 - Review of Backtest & GO LIVE process

Using VPS in the cloud, ideas to minimize risk during drawdowns, troubleshoot bots. Discuss bot 3 (hybrid day trading and swing trading bot), other NinjaTrader 8 bots, advantages and disadvantages.

Class 7 - Parallel Testing and End of Week Test Reviews

Introduction to how to review live trades vs back test trades over the same time period, focus on single day optimizations, parallel test results of back test vs live trades for the week and breakout sessions.

Class 8 - FINAL Review, Build Run Sheet and Plan for Next Month

Final review of the process for reviewing a new bot, starting with bucket testing, optimization, settings file templates, report export and building a run sheet to keep all your tests & bots organized.

Video Testimonials

Testimonials

I appreciate your class, it’s been great and I’ve learned a lot.

Looking forward to opening up two accounts. A lot of things have been cleared up for me from this class. Thank you to you and your company.

- Christobal

★★★★★

Always thought trading was for those with deep pockets. Real Life Trading has give me a different outlook for where I want to head and helped me realize that trading can be for everyone.

I am from Africa, where there is a lot of hunger, if this can help me make a make some extra money to feed a few kids, that would be great.

- George M

★★★★★

I’ve been very pleased with this class, I’ve learned a few things, and already applied them to my manual trading.

I feel like I have barely opened the door to learn all these things, I look forward to learning more. I’ve very excited about this.

- Marsha

★★★★★

I plan to start slow so I can understand how everything works.

I’m very rules based, so this takes all the gray decision making out.

- David H

★★★★★

I just love this class.

I’m looking forward to getting two trading accounts going and to supplementing our income.

- Kelly L

★★★★★

I love scaling it up. I love the data analysis and the automation.

It’s really helped me to analyze real markets and what’s going on. It’s rule based and structured.

Love the passive income aspect of automation. I appreciate what you’re doing and really enjoyed the class.

- Jacob M

★★★★★

I like the automation and the bots. I really look forward to that automation.

I have one account now and look forward to having two accounts soon.

- Lucien W

★★★★★

It’s been an awesome class. Thank you for all you’ve done for us, training us to use the bots. I love the idea of the potential for the seed accounts to be able to open more than one account.

- Josiah M

★★★★★

There were so many “aha” moments and takeaways The bots were really great.

- Harold C

★★★★★

To even learn this existed, to do bots, was such an “aha” moment for me.

You guys are the real thing.

- Paige W

★★★★★

I loved the optimizer. I clicked on it and let it do its thing and it was amazing.

- Ben A

★★★★★

My “aha” moment was that I needed a bigger monitor

- Buddy C

★★★★★

I’m extremely entry level and have never really done day trading in the past.

My “aha” moment was realizing that it was more about data analytics than trading. That I could just run the test and analyze the data.

- Drew H

★★★★★

Today we got to see a larger variety than just being focused on our own trials. Seeing everyone’s sheets was very educational.

The more you see the more natural it will become.

- Dave A

★★★★★

It was awesome watching you go through everyone’s homework. I don’t think that I’ve looked at anyone’s as intensely as you did. It was a really cool thing to see.

I just want to ignore my job so I can just do this.

- Kelly D

★★★★★

Coming into this I knew that my problem was going to be getting stuck in optimizing this. The rules you gave were so helpful getting me out of that.

Seeing everybody’s stuff has given me so many ideas and angles and ways to look at this. I loved seeing all the different people that are doing a different bot every day of the week. I’m really excited to see where this all goes from here for everybody.

- Stephen B

★★★★★

This has been hugely educational and it’s given us a much greater appreciate for what you’ve done here, Matt.

The coolest part has been the back testing for day trading. What do I need to be looking at, learning that frame and how to utilize back testing for a variety of reasons has been very cool.

- Scotty E

★★★★★

Thank you for giving your time & energy to teach this bot class. Your heart to help & serve others is clearly evident, and I appreciate you!

My wife, Sheri, & I look forward to working with you more as we continue our trading journey.

- Rob J

★★★★★

Top 7 reasons why students are raving about the bot trading class

1. Trading Automation

Eliminates manual labor in trading.

Reduces the risk of errors in trading decisions.

Increases trading speed for quick order execution.

2. Funded Trading Accounts

Opportunity to get a funded trading account for as little as $29/month with Apex Funding.

The account grows by 6%, and the money becomes "real" with a 75/25 gain split, 90/10 available as add on.

3. Automated Trading Bots

Use trading bots to grow funded accounts without needing to write code.

Bots can make money in both rising and falling markets, reducing stress during market fluctuations.

Bots allow for continuous trading for up to 6.5 hours for stocks, 23 hours for indexes and forex and 24/7 for crypto, generating potential profits.

4. Automated Backtesting

The bots live within our software, and are available for free (but only in class).

Backtesting helps simulate trades and refine strategies for optimal performance.

Run thousands of automated backtests to identify profitable strategy & settings combinations.

5. Reduced Time and Effort

Automated trading saves time and effort on manual order inputs.

Focus more on trades and high-earning opportunities.

Avoid missing trading opportunities due to personal commitments or fear of missing out.

6. Potential for Passive Income

Trading automation allows you to set up multiple funded accounts to generate passive income.

Snowball your earnings by growing accounts, getting funded, and purchasing more funded accounts.

7. Empowerment and Impact

Trading automation provides opportunities to pursue dreams, make a difference for family and community, and achieve financial goals.

Overall, trading bots offer the benefits of efficiency, precise order entry, statistical probabilities, continuous trading, and the potential for passive income, empowering individuals to pursue financial independence and ultimately make a positive impact on their lives and communities.

Frequently Asked Questions

Can I use bots to help get a funded account unlocked?

Yes, that is one of the top reasons traders use the bots, in addition to the time freedom.

If bots make the trades for me, why do I need a class?

Bots are sophisticated technology, you need to understand how to test & operate them.

Once class ends, will the bots still be available to use?

You can use the automated trading bots as long as you like. At the end of class, you're also offered a 30-day free trial of the premium community, but the bots function independently, regardless of whether you join the optional / premium community.

Once class ends, how much support is there for questions, troubleshooting, etc?

You get 30-days to the $150/month (optional) premium community and gets access to resources, bot updates, and a weekly 30-minute live Q&A video for questions, which provides ongoing bot trading support.

What platform does this technology work with?

The bots operate within our preferred trading software, NinjaTrader 8, which is compatible on Windows-only operating systems. If you use a Mac, you can install Parallels to get it installed on a Mac. More about our recommended trading software.

Are the bots appropriate for me if I currently have no experience trading?

We have had plenty of people who have never placed a trade in their life sign up for the bots course. Some extra knowledge on trading wouldn't hurt, but is not necessarily required.

What happens if I miss a class, is it recorded?

Yes, every class is recorded and sent out to each student. If you miss a class you will be able to go back and watch the entire session

How many bots do you have and how many bots will I get in class?

Matt has about a half dozen bots that have been created, however, in class, we really go over about 2 different entry-level bots and spend time on each one where explain how the bot works, how the strategy is executed, and related homework to go back and find some things that it works really well on so we can talk about it the next class. Matt shows you how to use all of the tools during class.

Can you provide a video of the bots in action?

There is a playlist where Matt explains the ORB and Snapback bot and how they operate here.

What is the success vs. failure rate of the bots?

It is difficult to say the failure to success rate of the bots since you are the one deciding what to run them on. Each bot has about a dozen different settings, which I will show you how to think through which settings to use. Ultimately you will be making the decisions on what you want to run each bot on.

Do I need an prop firm / assessment account for this class?

No, you don't. Matt will actually give you the paper trading account to use. If you are interested in getting an assessment account at the end of the 4 week bot trading class, by all means you are able to do so and have the bots run the assessment challenge account.

What size account do the bots work on?

It works on any account size. Each trading bot comes with customizable settings, allowing you to easily adjust parameters such as risk level based on your account size.

Do you offer any guarantees or return policy if the bot does not work as expected?

You aren't paying for the bots, you are paying for the TRAINING of how to run the bots (test, optimize and operate them). Matt GIVES you the bots for FREE, but only when you join the class. Matt demonstrates you how to think about what timeframe, ticker and charts to run them on, based on previous backtest results.

Where do I go to sign up for the class?

Click the AM or PM sessions you want to join at the BOTTOM of this page.

Where can I reach out to for more information?

Email us at hello@pushbuttontrading.co OR Book a call

February 6 - 29

Tue + Thu @ 8:30am EST or 8:00pm EST

(Online Zoom)

$1,799

SIGNUP NOW

$1,799 includes the following

Includes link for free download of our software platform

Include a backtesting tool to assess numerous variations of pre-built bots automatically.

Includes 8 LIVE classes (2x a week), each class ~ 1 hour

Includes online video resources and community

Includes FREE $100k paper trading account with ThinkMarkets

Includes integration to TradersPost (separate fee)

Includes 30-days of PREMIUM community access (after class completion)

Certificate of completion

May 2024 Schedule

May 7 - 30

Tuesdays and Thursdays

8:30am EST

BOT Trading

with Matt DeLong

15 students MAX

May 7 - 30

Tuesdays and Thursdays

8:00pm EST

BOT Trading

with Matt DeLong

15 students MAX

$1,799 includes the following

Includes link for download of software automation platform

Include a backtesting tool to assess numerous variations of pre-built bots automatically

2 pre-built bots and videos explain their strategies

Includes 8 LIVE classes (2x a week), each class ~ 1 hour

Includes online video resources and community

Includes 60-days of PREMIUM community (30-days after completion)

Certificate of completion

Have a question?

Risk Disclosure: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Testimonials: Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Push Button Trading

is an affiliate of Prop Account, LLC. All funding assessments are provided by Prop Account, LLC and all assessment fees are paid to Prop Account, LLC. Trader Agreements are handled by Prop Account LC. Neither Prop Account, LLC nor Prop Account LC provides any trading education or other services. Such services are provided by

Push Button Trading.

© 2020 - 2024 by Push Button Trading, LLC, All Rights Reserved | Terms of Service | Push Button Trading Terms and Conditions | Privacy Policy